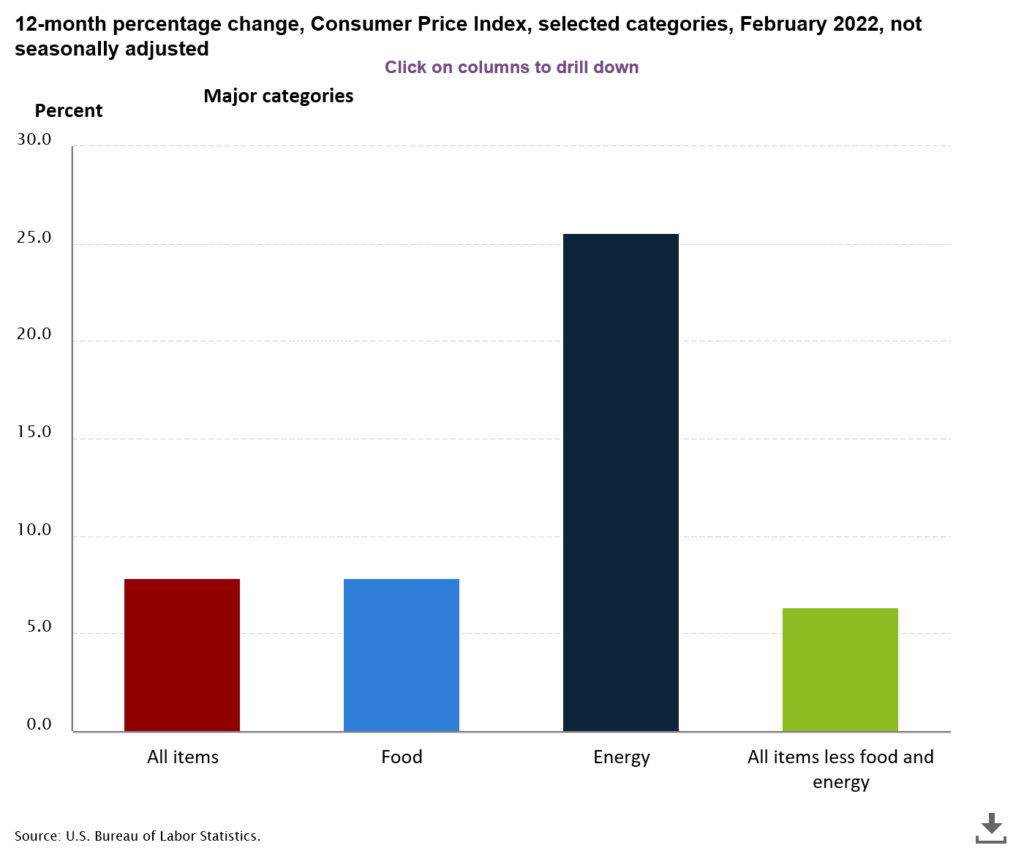

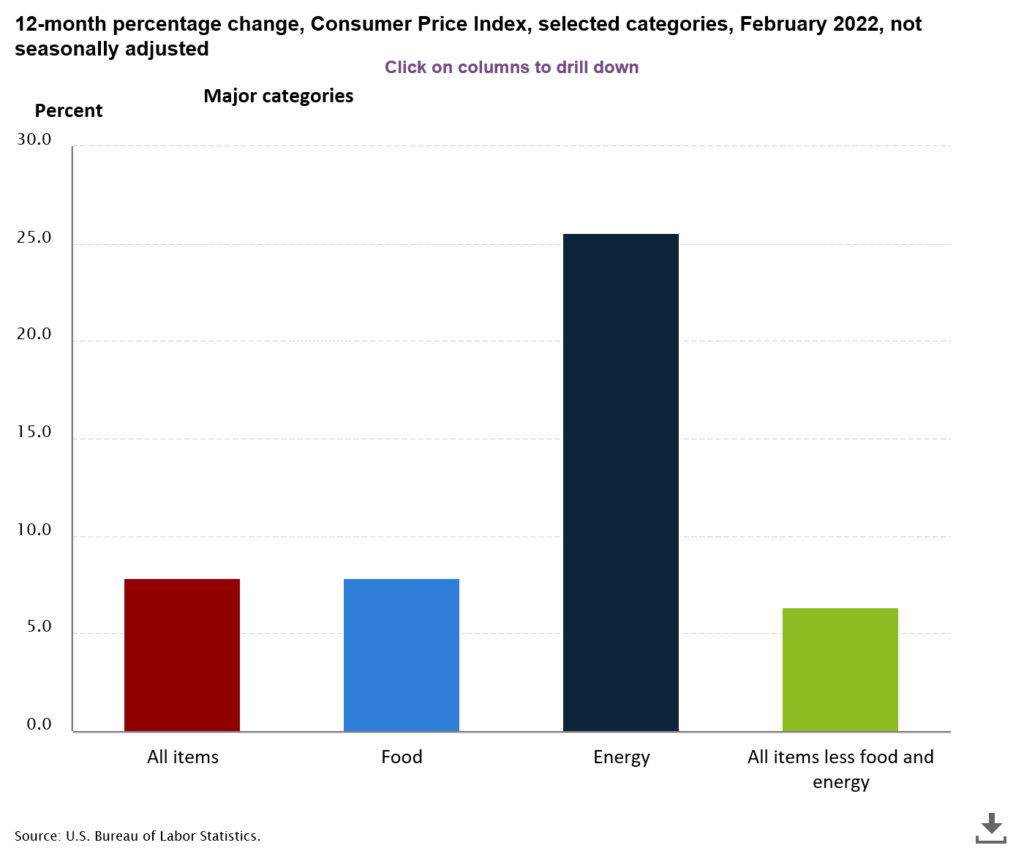

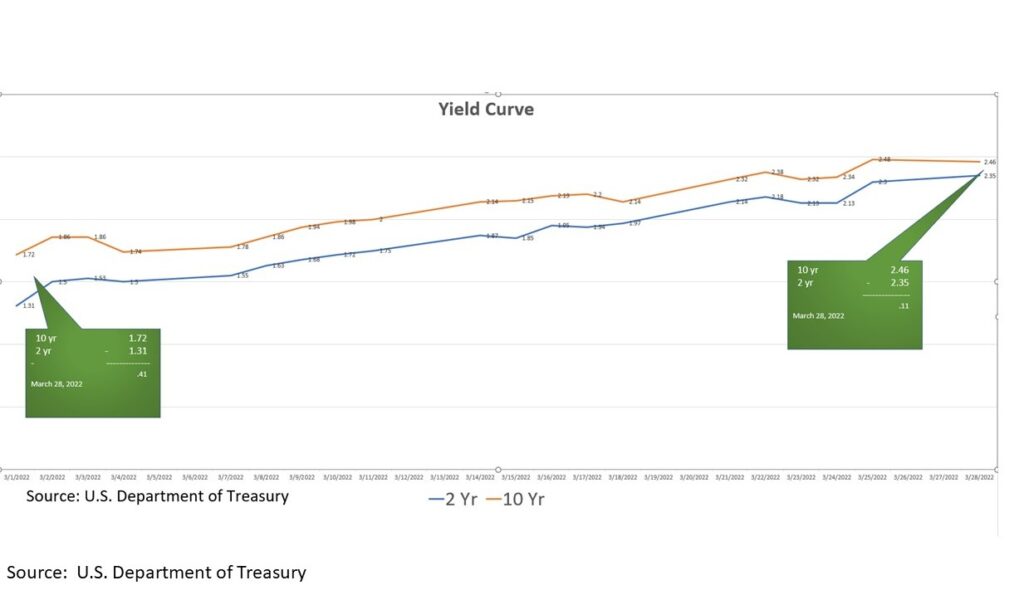

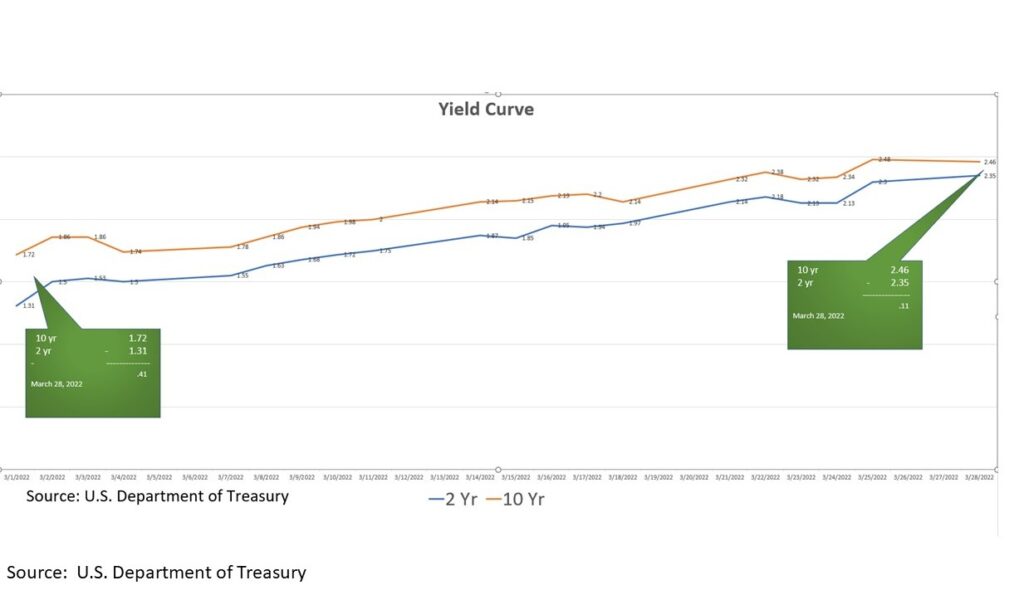

As the government keeps printing money out of thin air, there is no doubt that the effect is the rising cost of all goods and services. Energy is one of the major categories that rises the most. Everyone feels the rapid increase of the prices from the food we eat, the clothes we wear, to the car we drive. The war in Ukraine added more flame to the fire. How can the government now fight inflation? Are they gonna raise the interest rate? Are the Fed is too late in fighting inflation? There is a problem which is now fast approaching. According to U.S. Treasury data on March 24, 2022, the 10 yr US Treasury Yield and the 2 Year US Treasury Yield are fast approaching to inversion. Instead of quantitative tightening, are the Fed now force to have another quantitative easing? Please leave a comment on what will be the Fed’s next move.

The gap between 10 year US Treasury Note and 2 year US Treasury Note is narrowing, fast approaching to inversion.